Money that saves itself for that rainy day

Money that saves itself for that rainy day

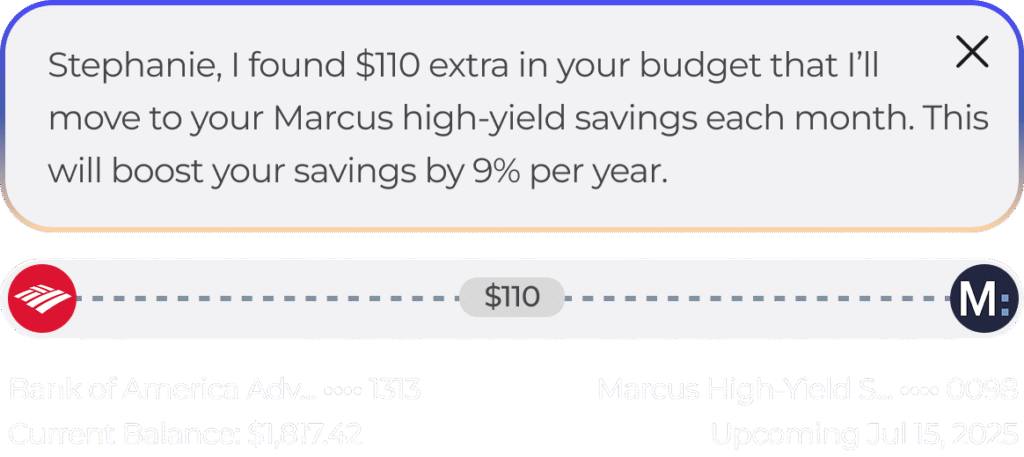

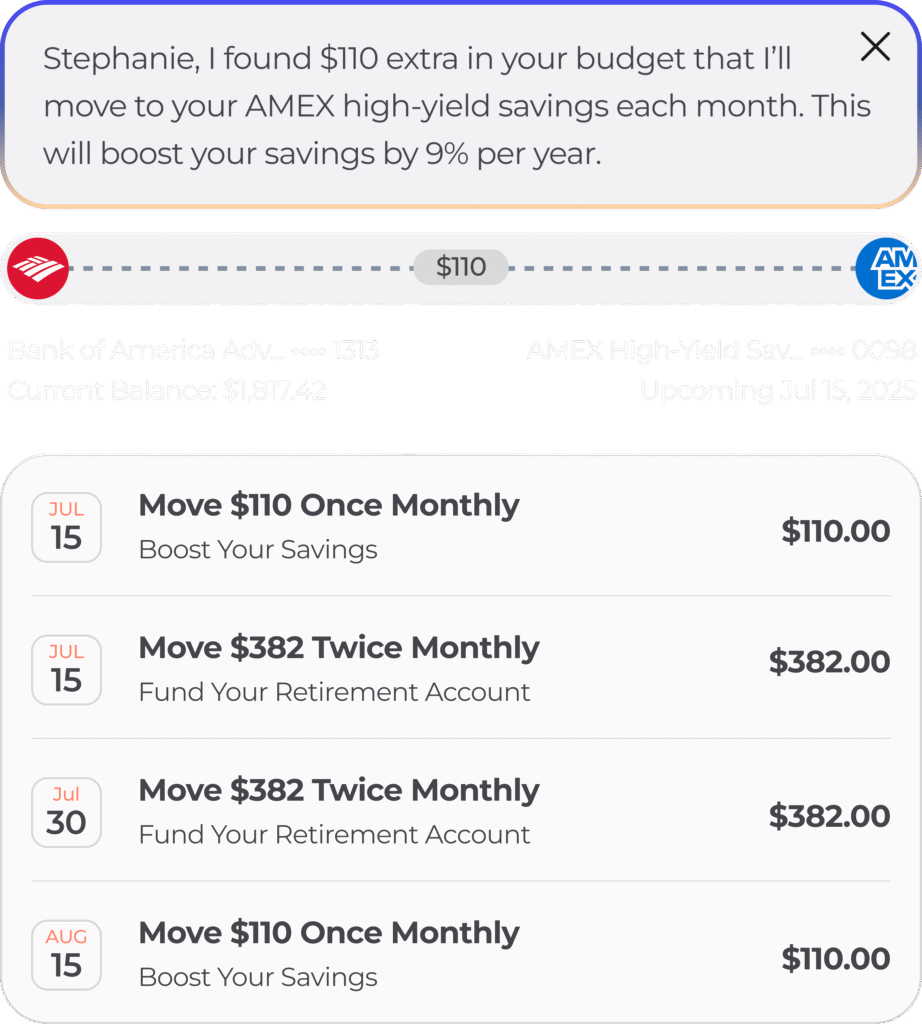

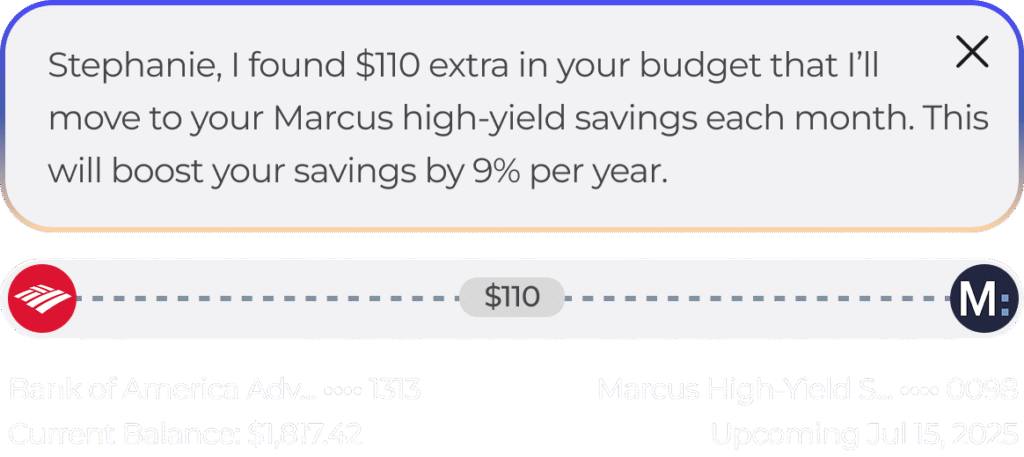

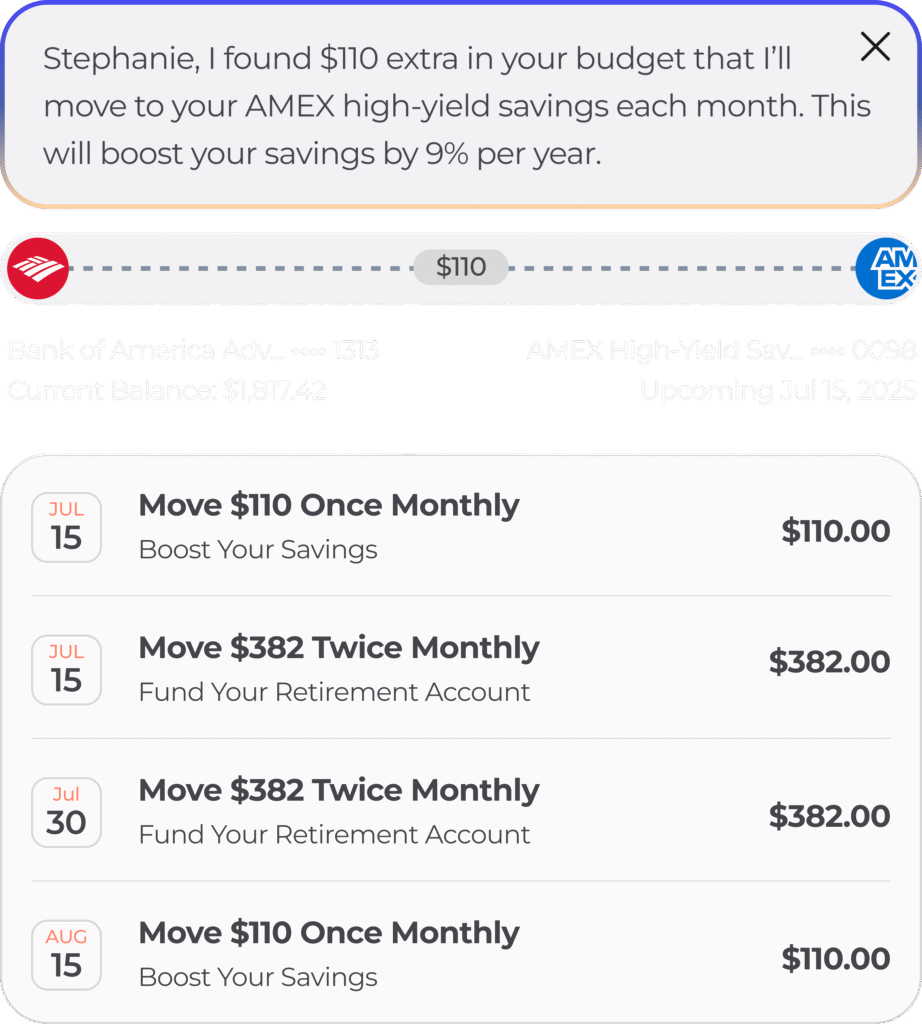

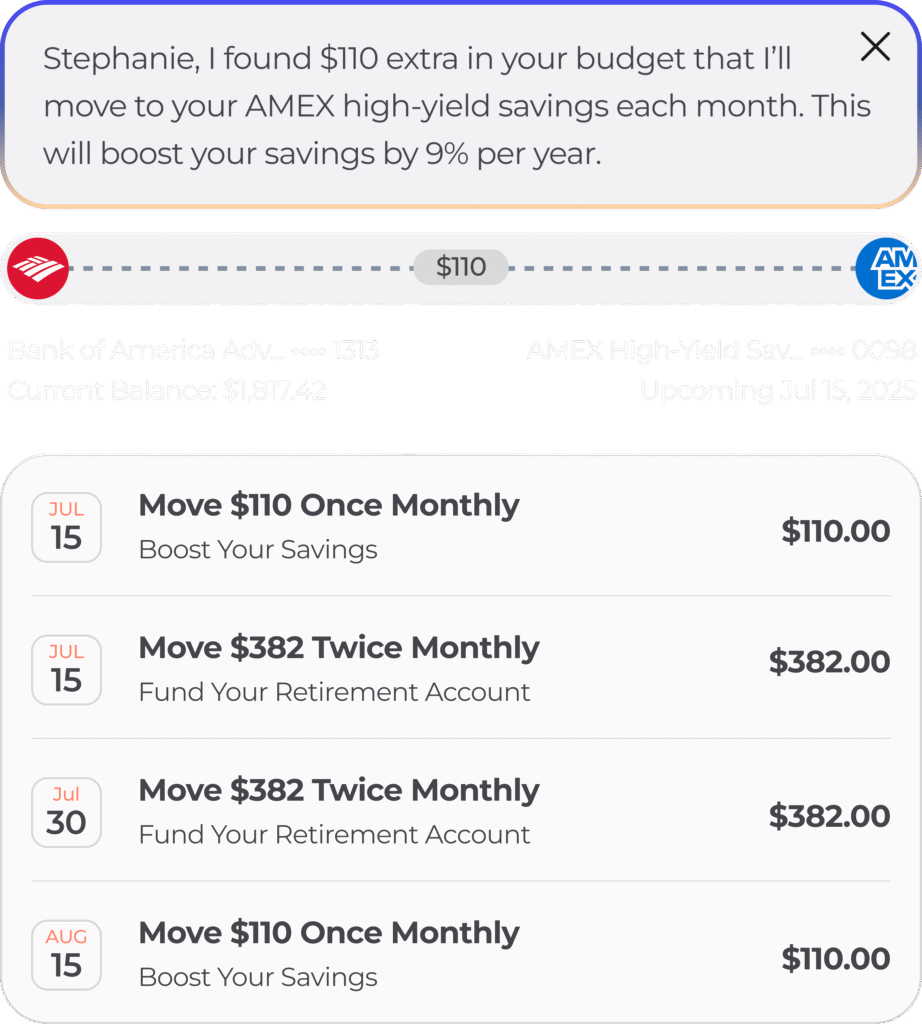

- Personalized AI recommends plans for retirement and general savings

- Piere automatically moves money into any connected account 1 2

- Your savings plan updates to meet changing circumstances

Join thousands saving 10% more3

Money that saves itself for that rainy day

- Personalized AI recommends optimal savings steps

- Piere automatically moves money into any connected account 1 2

- Your savings plan updates to meet changing circumstances

Join thousands saving 10% more3

Money that saves itself for that rainy day

- Personalized AI determines your optimal savings amount and explains recommendations

- Piere moves money into any connected retirement or savings account—automatically 1 2

- Your savings plan can update automatically as your income and spending change

Join thousands saving 10% more3

Next Up: Growing Money On Trees. (Someday.)

Save 10% more without trying

Connect your accounts to Piere, and let the personalized AI behind MyPlan™ create and manage your savings plan.

In seconds, get insights about spending habits, smart automations for saving money, and let Piere move your money automatically so you can save for tomorrow, while enjoying today.

A savings plan with all the answers

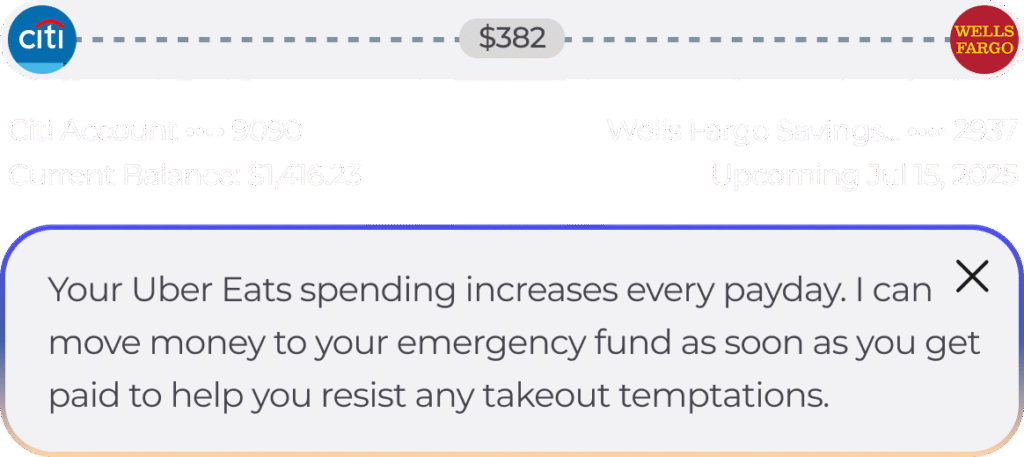

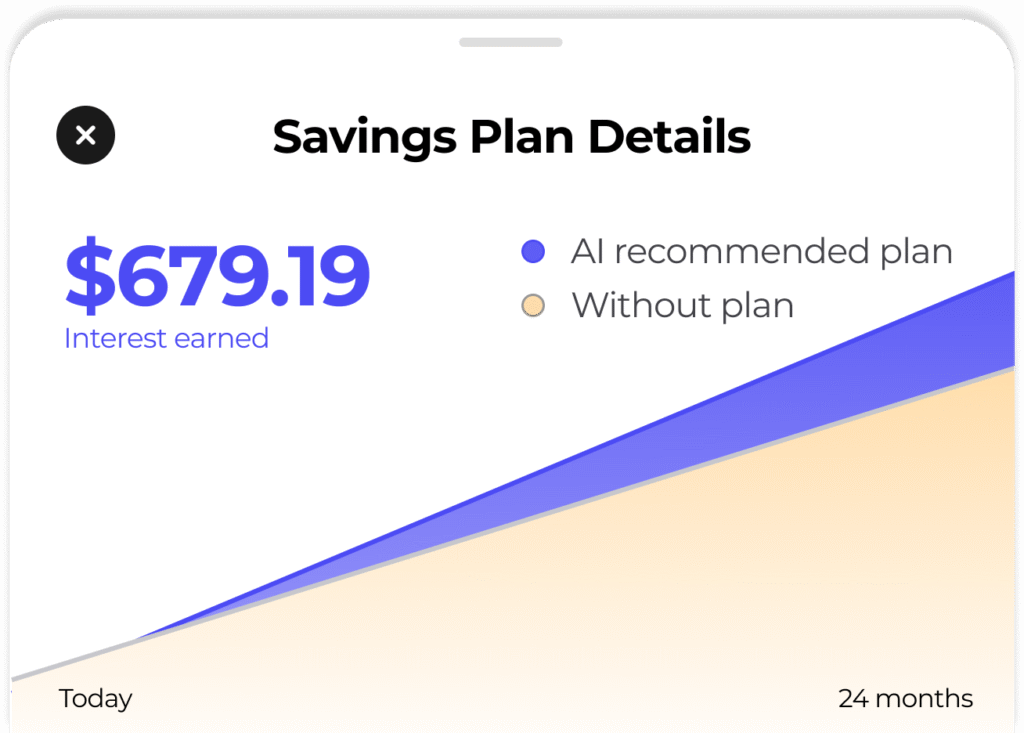

MyPlan™ AI in Piere gets to know you: what you like, what you don’t, what your spending blindspots are. With you and you alone in mind, it creates personalized plans for saving money that you can actually stick with.

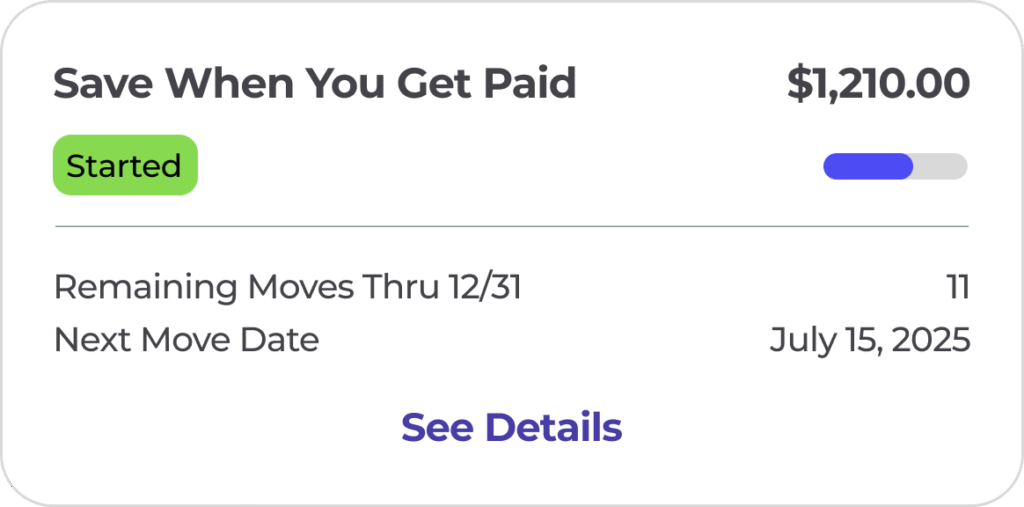

Along the way, track progress towards your savings or retirement goals, and see insights as your plan adjusts.

With Piere, saving money is excuse-free

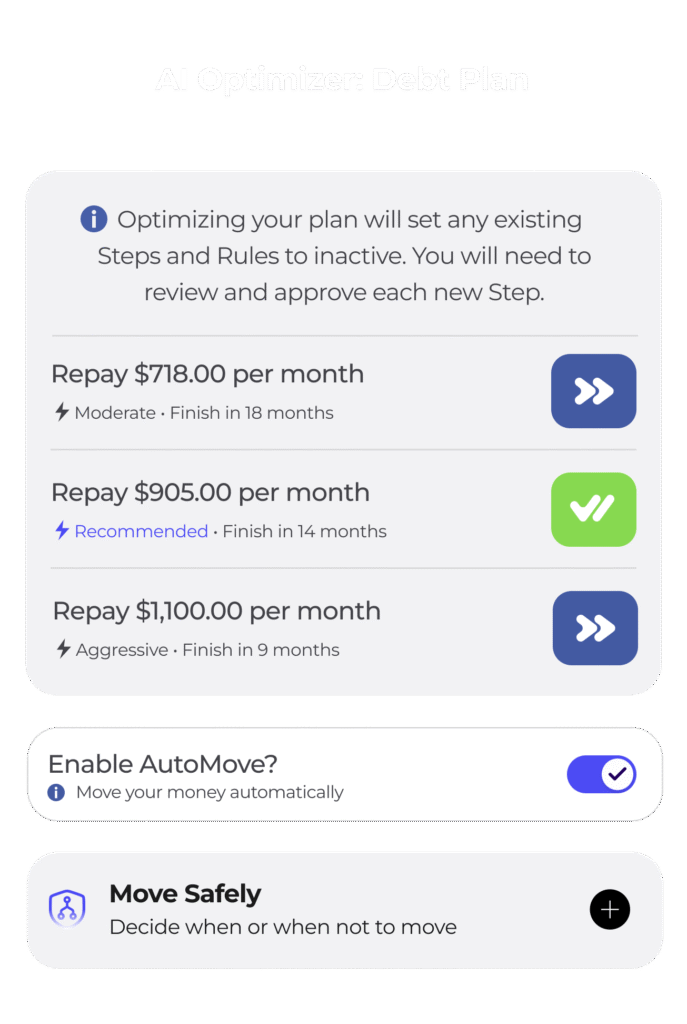

Knowing how much to save and having the discipline to stick with a savings plan are hard. Piere removes the stress, temptations, and questions, automating your retirement savings, emergency fund, and fun money.

We cover 99% of institutions in the U.S. and Canada, so forget the financial stress and let Piere manage your savings today.

Here's how

it works

Get Safely Connected

Securely connect your accounts in the Piere app and see your balances, income, and spending transactions

MyPlan AI Takes The Wheel

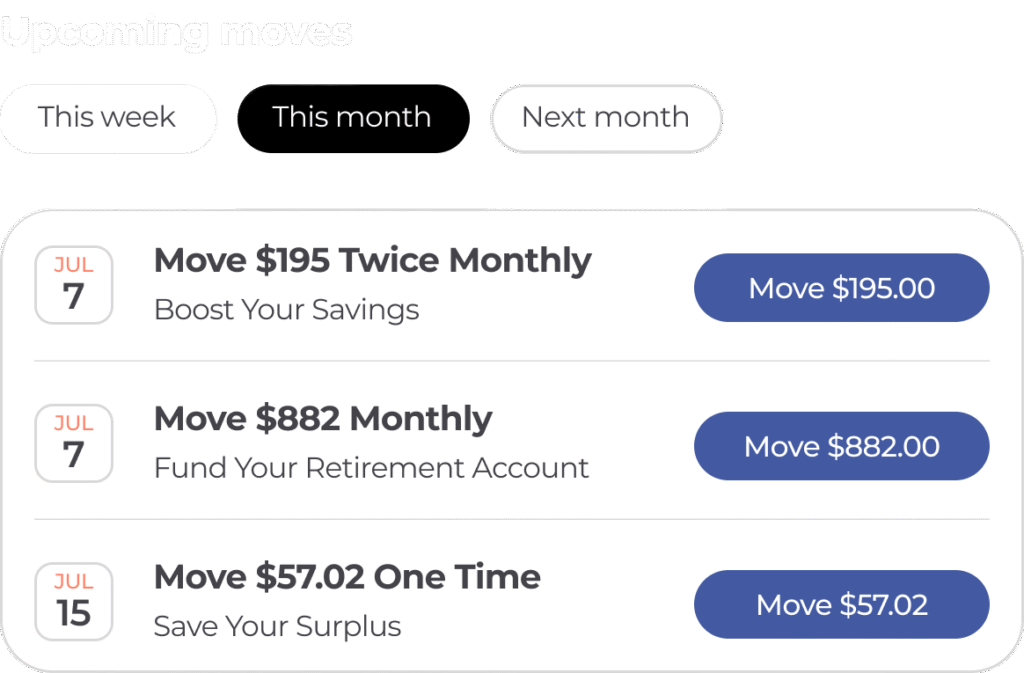

Piere’s AI analyzes your spending and income to create a personalized savings plan that’s fully automated

Take Control At Any Time

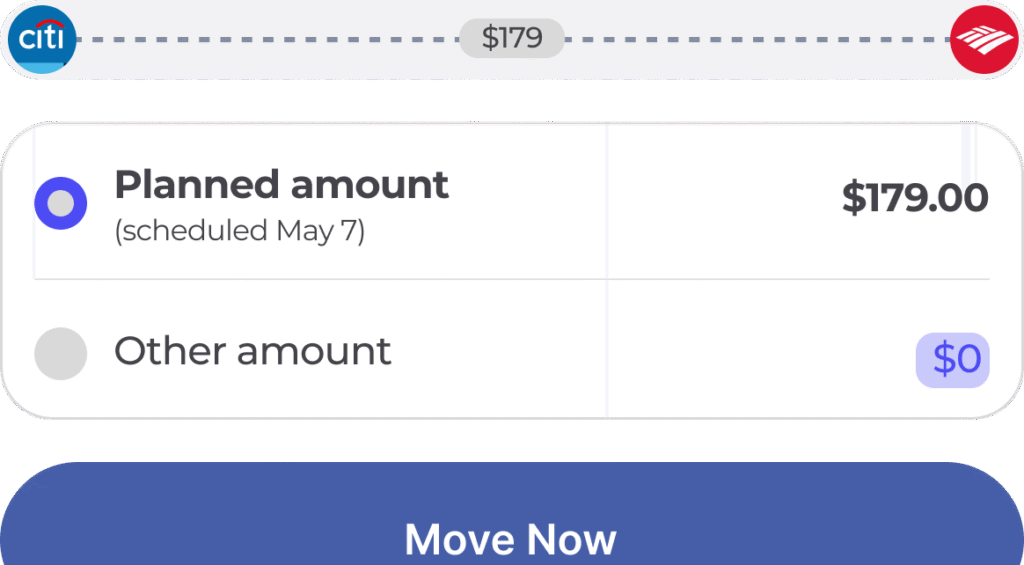

Set custom rules and soon, move money to your connected savings and retirement accounts from Piere

FAQs

What is a MyPlan™ savings plan?

MyPlan™ is Piere’s personalized financial planning tool, powered by AI that adapts to your unique situation. A MyPlan™ savings plan shows you exactly how much you can safely set aside each month for your retirement and savings needs, while still covering your bills and everyday expenses. It balances your checking and savings needs, then gives you clear, achievable steps to grow your savings consistently – even moving money for you. You can find and manage your savings plan anytime in the Plans tab of the Piere app.

How does it work?

When you securely connect your accounts in Piere, MyPlan™ AI reviews your income, balances, and spending patterns to calculate what you can realistically save and contribute to retirement accounts. It then creates a step-by-step plan that fits your lifestyle, showing you exactly when and how much to set aside. Piere keeps track of your progress and, with automated money movement coming soon, will even be able to transfer savings and retirement contributions for you automatically. The more accounts you connect, the more precise your plan becomes.

Can Piere help me save more?

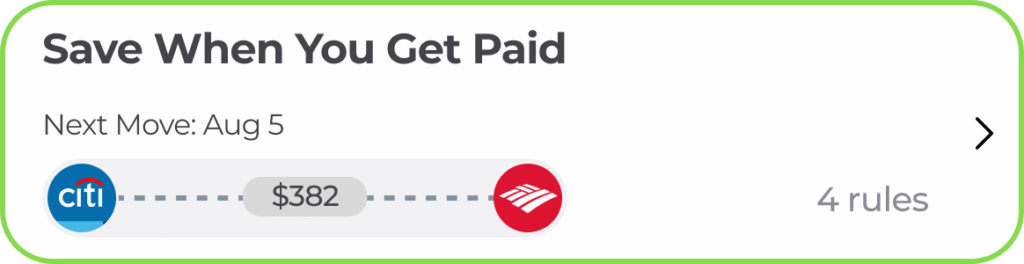

Yes. Piere can help you save more in several ways. On average, users save about 10% more when using the app. Piere continuously monitors your income and spending to uncover new opportunities to save, and MyPlan™ can automatically set up “savings Moves” around key moments like payday. This helps you build savings by automatically moving your money to savings or contributing to your retirement, removing the temptation to overspend, keeping your goals on track.

Is Piere a bank?

Nope, we’re not a bank. Piere is a financial technology platform that works with 99% of institutions in the United States and Canada. You can bank where you’d like, and by connecting your accounts to Piere, MyPlan™ will just work for you and your savings plan.

How does Piere protect my money?

Piere doesn’t touch your money or your bank accounts. We and our technology partners use bank-level encryption to securely connect to your financial institutions, allowing us to view your financial data. We only process a Move (a transfer) when you’ve given us explicit instructions to do so.

Can I trust the AI in Piere?

We’ve tested the AI behind Piere and MyPlan™ ourselves, and with a large group of real Piere users. The feedback we’ve gotten has been incredible, helping us to improve the accuracy and reliability of the AI’s recommendations. At any point, you’re free to edit the steps created in your savings plan, although we’re proud of what our AI is already achieving for our users.

1 Fully automated money moves coming after Q3 2025.

2 Our data providers can connect to 98%+ of banks in the U.S. and Canada

3 Piere users save 10% more on the platform vs. before in their first 90 days